How to invest in America's nearly $2 trillion shot in the arm

Analysts and economists at Jefferies said in a report this week that companies with direct ties to consumers — such as retailers and leisure firms — stand to benefit the most.

That's because many Americans who have been largely stuck at home for the past year and able to conserving cash may be itching to get back out to shop and travel.

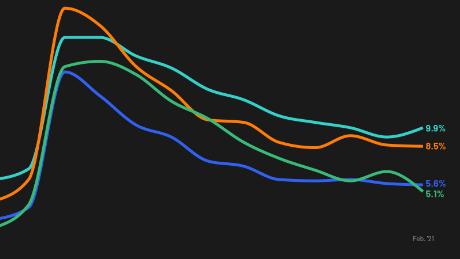

Stimulus money will only add to that potential spending firepower. The government recently reported that the personal savings rate in January was 20.5%. Although that's down from the peak of nearly 34% last April, it's still well above the pre-pandemic savings rate of 7.6% in January 2020.

Will consumer spending boost cyclical stocks?

"We see the makings of the strongest consumer stock backdrop in decades," said Jefferies chief economist Aneta Markowska in the report, adding that spending should be "robust" through 2022 as the "vaccine rollout and re-opening of services merge with stimulus and elevated savings."

The Jefferies analysts specifically cited Airbnb, restaurant chains Bloomin' Brands (BLMN) and Brinker (EAT), theme park operator Six Flags (SIX), Southwest (LUV) airlines, Lyft (LYFT), Home Depot (HD), Lowe's (LOW) and TJX (TJX) as having the best chance to gain as consumers spend stimulus money and venture back out into the world.Other strategists note that economically sensitive sectors have a chance to outperform thanks to stimulus.

"The rotation out of tech and other growth stocks into cyclical areas of the market has further to run," Mark Haefele, chief investment officer with UBS Global Wealth Management, said in a report. "We recommend investors tilt their stock exposure to sectors that are likely to benefit from higher growth and a steeper yield curve, including financials, industrials, and energy stocks."

In other words, the momentum behind the so-called FAANGs, as well as Microsoft (MSFT) and Tesla (TSLA), could finally start to wane. (We know. You've heard that before, but this time it may actually happen.)Avoid value traps — and think globally

Analysts may start to pay more attention to value stocks, but investors need to be careful to not just buy stocks that look cheap. Those can be so-called value traps, stocks that are trading at low valuations because they aren't growing very much, or are shares of zombie companies with high debt loads.

"The name of the game is quality for value stocks," said Thomas Friedberger, co-chief investment officer with Tikehau Investment Management. "Look for the companies with the right management teams and strong balance sheets."

The Biden boost to the economy could also help global markets.

"Stimulus is good news for the cyclical recovery in the United States but around the world as well," Friedberger said, adding that America's neighbors Canada and Mexico could get the biggest boost from US stimulus but that European and Chinese companies should benefit as well.

Some bonds could get a stimulus boost too

Plus, investors can find other opportunities beyond stocks. Karel Citroen, head of municipal research at Conning, noted in an interview with CNN Business that state and city governments will be receiving about $350 billion in aid as part of the Biden stimulus package.

That means the stimulus should give a boost to municipal bonds tied to local government spending. Citroen pointed out that governments will be able to use some of the funds to help offset the loss of revenue due to the pandemic as well as help pay directly for Covid-related expenses.

Citroen added that states and cities will get an indirect lift simply because the stimulus will boost the overall economy.

"The federal aid should help tax collections because consumers will go out and spend more, which will lead to higher sales tax revenue," he said.

Citroen didn't recommend any specific state or local municipal bonds to buy. But fortunately for investors, big money managers such as Pimco (MUNI), BlackRock's (BLK) iShares (MUB), Invesco (BAB) and VanEck (HYD) all offer diversified municipal bond ETFs.

No comments:

Post a Comment